Mom Talks About Debt Draws a Budget Plan

Dreams, these days, come up with a loftier price tag. A automobile for Rs 5 lakh, a house for Rs 50 lakh, several lakhs for a decent education for kids and crores for a cushy retirement. In fact, seemingly simple needs have been elevated to dreams due to the high cost associated with them. You require either a big income or a strategic program to meet these basic life goals.

While the former may not always exist easy for the average salaried person, the latter is certainly within reach, especially if yous begin at the commencement. Make a fiscal plan the 24-hour interval you starting time working and you lot won't take to scramble to fund each aspiration.

Yet, information technology may not be as like shooting fish in a barrel equally it seems. "I just don't know how much to save and where to invest, so I don't budget and end up spending a lot," says Harshinder Kaur, who started working two years ago as a probationary officer at a depository financial institution in Ganganagar, Rajasthan. She doesn't know how to codify a program for herself. This is a predicament many youngsters in their mid-20s face. The twin behavioural devils of ignorance and procrastination push most people into their 30s before they become downwardly to streamlining their finances. This often results in faulty investment choices, flawed portfolios, unmet goals and financial insecurity after in life.

"This category is not a greenbacks cow for advisory firms, and as they take no ane to plow to, they often go lost," says Jayant Pai, CFP and Head, Marketing, PPFAS Mutual Fund. We, at ET Wealth, will try to remedy this through our embrace story this calendar week. In the following pages, we offer the newly employed youth a step by step guide to plan their finances. Nosotros focus on the building blocks they demand at this stage: budgeting, goals, investment, insurance, taxation and salary structure. However, this is merely intended to propel them into planning and they will need to research and learn continuously throughout their working lives. Recollect, financial liberty is non accomplished the twenty-four hours you get-go working, but the day you get your finances in working society.

Also Read: Young earner? 5 financial mistakes you lot may regret subsequently

1. Brand A Budget & Starting time SAVING

Budgeting is the simple exercise of reconciling your income with your expenses, and should be your first footstep. Note downwards your monthly spending as per your ease of usage: Excel sheet, simple diary, mobile app, or desktop. The aim is to know how much you spend under various heads. "I use Excel sheet to continue track of my spending and know what percentage of my salary goes where," says 24-twelvemonth-sometime Saugata Palit, who has been working as senior executive in a private firm in Delhi for the past 18 months.

Later on you take budgeted for iii-4 months, you will realise that your expenses tin can be sorted into three categories: essential, discretionary and entertainment. "Tracking of budget is important not only to place mandatory and discretionary spends, simply also ensure that you don't overspend," says Vinit Iyer, CFP & Founder, Wealth Creators Financial Advisors.

Once you've identified the outgoing corporeality, put abroad 10-20% of your bacon every calendar month before you kickoff spending. If yous don't know where to put it, starting time with your banking company account. Effort to opt for a sweep-in account that has a stock-still deposit linked to information technology as it will fetch you a rate higher than 4%, which y'all get from your savings business relationship. This volition help inculcate a lifelong saving addiction and make sure that you money starts to work for you immediately.

As fiscal planner Pankaaj Maalde says, "It's important that your money does non lie idle." This is considering with very few liabilities and responsibilities, this is the ideal flow to save and take advantage of the power of compounding. The earlier you showtime saving, even if information technology is a small corporeality, the more time your money will take to grow.

Fifty-fifty equally y'all first saving, another commencement is to commencement educating yourself about every aspect of personal finance. "Read articles and books to empathize concepts similar saving, investing, protection, debt, inflation, compounding, etc, and how these are intertwined," says Pai. The more informed you are, the better your conclusion-making.

Too Read: Practise you know your financial personality? Accept this quiz!

2. FRAME YOUR FINANCIAL GOALS

You have started saving, simply will you take enough to purchase a house 10 years downwardly the line, or fifty-fifty a car 5 years hence? People tend to save aggressively and invest with extreme vigour, but do so blindly, jeopardising their goals. This is a mistake common to virtually investors, irrespective of the age grouping. The next footstep then is to frame your goals.

Don't simply make a mental note of the things you want to finance, but write these downward in detail. Split your goals into three categories: short-, medium- and long-term goals. And then listing each i clearly, along with the number of years to accomplish each, and the exact corporeality you volition need. One time you have penned down your goals, you will be able to determine how much and for how long y'all will need to invest.

Don't forget to factor in inflation while calculating the amount since information technology will shoot upwards the value of your goal. If you decide to buy a car that costs Rs v lakh today after vii years, it will cost you Rs 8.5 lakh if you consider 8% inflation. Similarly, the post-tax returns from a stock-still deposit that offers 7.five% return may not be able to beat the rise in prices over the long term.

While Palit manages to relieve 29% of his salary each calendar month and has too framed short-term goals, he hasn't factored in inflation, nor the corpus he volition manage to build. At that place are other things you demand to consider while deciding goals. "The nature of your income, earning capacity in the coming years, dependants, loans and personal priorities must essentially exist considered while framing goals," says Pai.

As well think that these milestones may modify somewhat with your changing circumstances, say, afterward getting married or having children. You lot will then accept to make the necessary adjustments. If you lot think yous cannot do so on your own, take the aid of a financial adviser who takes into account your specific needs and wants.

Also Read: Young earner? Five financial mistakes you may regret later on

3. INVEST IN RIGHT INSTRUMENTS

The biggest dilemma that young earners face is where to invest their coin. "To start with, just cull elementary instruments like a recurring or stock-still eolith. Once you take prioritised your goals, then think about converting your savings to investments," says Maalde. "If you lot are not familiar with instruments, pick options that are readily available, say, in a bank, and offer liquidity," adds Iyer.

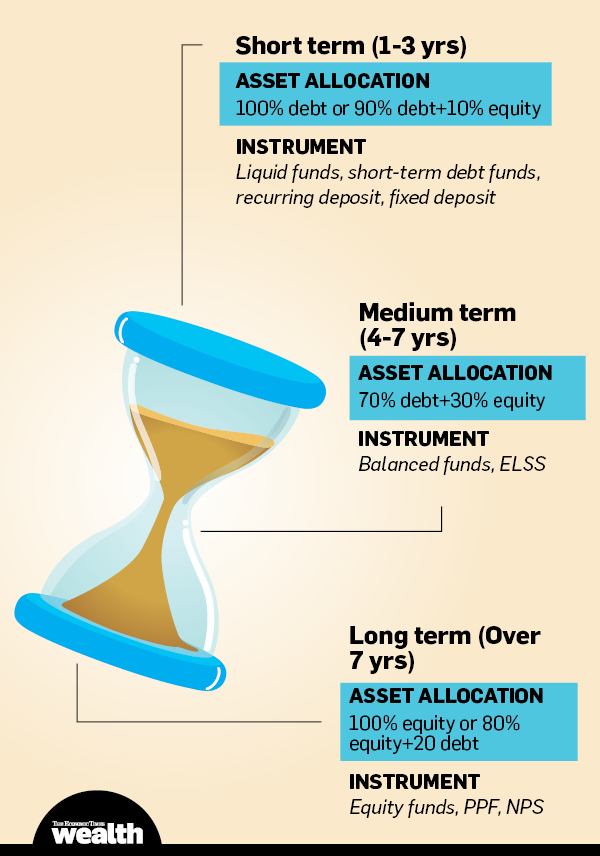

Essentially, the investment vehicle should be called in line with your goals and time horizon. "If it's a brusk-term goal, continue it in debt; if it'southward for the long term, it should exist mandatorily disinterestedness," says Kartik Jhaveri, Director, Transcend Consulting. The medium-term goals should accept a mix of debt and equity. This is considering debt will offer y'all the rubber of upper-case letter since you lot need it in the short term, while equity has historically given the highest returns in the long term.

This is a simple generalisation, merely as you take just started earning and are not familiar with the investing territory, get for it till you are better informed. So take into consideration other factors like returns, liquidity and tax liability before choosing an asset course.

For near-term goals, opt for recurring deposit, liquid funds, fixed deposit or short-term debt funds. For the medium-term, you could cull balanced funds and equitylinked saving schemes. For the long term, disinterestedness mutual funds, NPS, PPF and EPF could be your instruments of pick.

Do not blindly have your parents' and well-wishers' advice, but behave your own inquiry. Bengaluru-based Siddhartha Nayyar, 23, is learning from feel. "I tried my mitt at the stock marketplace recently, merely faced a loss. So I accept backed off for now and will acquit proper research on stocks and common funds before trying again," says the project coordinator with a software firm.

On the other hand, 24-twelvemonth-one-time Dharma Teja is learning from observation. "When I saw my father's investment go upwards sharply with common funds, I decided to opt for it and am now investing my entire surplus of Rs 45,000 in equity funds," says the product managing director with a private business firm in Mumbai. He is, however, accumulating funds for brusque-term goals and should shift it to debt as he approaches the goal. At the other extreme is Palit, who has a 100% debt portfolio, with investments in recurring deposit, PPF and gold ETF. He should diversify into equity soon.

Which investment should yous option?

Consider the goal tenure, returns, taxation and liquidity before investing your difficult earned money.

As well Read: Should immature earners take their parents' advice while investing?

4. MAXIMISE TAX SAVINGS

Saving tax is not a priority for virtually new earners because the salary is not too high, nor the noesis regarding taxability of instruments. "Practice not be obsessed with investing but for saving tax as some expenditures may be useful," says Pai.

However, information technology is important to castor up your revenue enhancement awareness at the primeval. Outset with avenues that offer taxation deduction of Rs 1.v lakh nether Section 80C. Some of these include the EPF, PPF, NPS, 5-yr taxation-saving fixed deposits, ELSS, Ulips, life insurance, etc. Then opt for investments that fit in with your goals and needs, or those that are beingness made by default.

The latter could include EPF or the NPS. "Yous could also use insurance and healthcarerelated expenses for dependants astutely," says Pai. These would include premium spent on wellness plans under Section 80D, which is up to Rs 25,000 for self and dependants, and Rs 30,000 for senior parents. "I only have a working noesis of tax equally it is not need of the hr for me. Still, I am saving taxation through investments in the PPF and gold ETFs," says Palit.

Another important affair is to calculate the returns from your investments after considering the taxation. So Palit should undersrand that golden ETFs will invite short-term or longterm capital gains tax. Y'all tin also save tax by negotatiating with your employer for a a taxfriendly salary construction.

Siddhartha Nayyar, 23 years, Bengaluru

Designation: Project Coordinator

Started work at 21 years

"I'm open up to investing in common funds, just want to test my learning in the stock market."

Flying showtime

i. Has no loans; has repaid vehicle loan.

2. Pays credit menu bills in total each month.

3. Working knowledge of tax on investments.

Take-off troubles

1. Fully invested in debt, no equity.

2. Low savings, high expenses.

3. But employer's health encompass. No other insurance.

v. OPT FOR THE RIGHT INSURANCE

The basic purpose of insurance is to cover risks in your life, not offer returns. Still, near people misfile it with investment because of the products in the market that offer both. While you may not feel much need for any kind of cover when you are young, it's best to know virtually the various types at the commencement of your financial life. "The lure of tax saving and the urgency to get tax planning components in place at the end of financial year can push button i to make unwise choices," says Antony Jacob, CEO, Apollo Munich Health Insurance.

Life insurance

The term programme offers a big cover for a small premium, merely you do non get any returns. And then, there are traditional plans, which include endowment and moneyback policies. These offer small covers for a high premium, and low rates of return. Finally, there are Ulips, which are marketlinked insurance plans with a lockin period of v years and provide a low cover for a loftier premium, only offer market-linked returns.

The last 2 are typically used The last 2 are typically used as a wealth creation tool because of returns, but think that in case of traditional plans, the rate is low, usually 5-six%, and you can earn college returns by investing in other instruments. Teja is paying a premium of Rs 25,000 a year for an endowment programme that was bought for him by his father even though he doesn't need information technology.

At this bespeak, the only life cover you may demand is a term programme, simply this as well, but if you have financial dependants or large liabilities in the form of debt. Teja has a Rs 75 lakh term plan though he has no dependants or liabilities however. Harshinder, on the other hand, has not bought any embrace. "Since I am single and don't accept whatsoever dependants or debt, I didn't think I needed any life cover," she says.

Health insurance

The broader categorisation includes the basic indemnity plan, which covers hospitalisation expenses, for an private, and the family floater program, which includes your entire family in a single cover. "Growing incidence of lifestyle diseases and rising medical costs make it essential to have a health insurance," says Ashish Mehrotra, CEO & Dr., Max Bupa Wellness Insurance. "Besides, a health program provided past an employer may not be enough to hedge one against the rising toll of healthcare services," says Jacob.

You lot should have Rs iii-five lakh bones health plan at this stage, depending on whether you stay in a metro or a tier II/3 city. So if your visitor insures y'all for Rs ii lakh, buy an independent pinnacle-up plan for Rs 3 lakh as it will be cheaper than a regular policy. Consider a family floater plan but when you are married and have kids; don't include your parents because the premium is determined past the age of the oldest member. Likewise, don't just consider depression premium equally a criterion. Look at the claim settlement ratio, infirmary network, inclusions and benefits before buying a plan.

Disquisitional illness plan

"This provides a lump-sum benefit in case of certain pre-decided ailments and pays the costs associated with longterm care and loss of income due to prolonged recovery period," says Jacob. It is available both as a standalone policy or as an addition with life and health insurance. Typically a standalone program will offer a higher encompass and more than flexibility. You can avert buying it at this stage, just consider it in your 30s given the college incidence of such diseases at lower ages.

Blow inability plans

This is a plan you should buy when y'all start working considering of the sheer unpredictability of life. It covers you against mishaps that tin result in consummate or temporary loss of income due to partial or total disability. Buy a encompass for Rs twenty-25 lakh or i in accordance with your income and nature of task.

Home contents programme

Though you are unlikely to have a house at this phase, buy a policy for the contents if y'all are in another city, not with your parents. The premium for a Rs 5 lakh encompass tin can be Rs three,000 and will encompass jewellery, home appliances, furniture, etc, confronting theft, fire and natural disasters.

Practise you know which comprehend you need?

Harshinder Kaur 27 years, Ganganagar (Rajasthan)

Designation: Broker

Started work at 25 years

Flying start

1. Complete clarity on goals.

2. Has health and critical illness insurance plans.

3. Clued in about insurance, taxation.

Take-off troubles

1. Has no upkeep.

2. Has no equity investment except in the NPS.

3. Loftier investment in tax inefficient stock-still deposits.

6. Improve YOUR Salary STRUCTURE

Y'all may have had the best package in campus placement, but the bacon would even so seem less compared to that of your seniors at piece of work. This is something beyond your command. What is in your hands is making the near of what the visitor is offer you lot.

The government does non recognise the concept of CTC in calculating for statutory heads, such equally Employee Provident Fund (EPF), Employees' State Insurance, gratuity and bonus, where the rules prescribe minimum contributions, there are no set rules on structuring the CTC. The salary break-upward is mostly the visitor's prerogative. In that location are broad norms, such equally the basic pay being 30-twoscore% of the salary, and house rent allowance (HRA) and other retiral benefits similar the EPF being a per centum of the bones. Yet, these likewise are not written in stone.

Moreover, what constitutes the CTC will vary from company to company. All CTC structures include three main components—bones, retiral benefits, allowances and reimbursements. Other components vary. Companies may or may non include variable payouts, such every bit performance bonus and gratuity in the 'full target remuneration'.

Also, benefits given in kind, for in-wages. This ways that except opinion, house, furniture and motorcar, are sometimes part of the total pay. Some companies even include premium paid for grouping benefits such every bit health and accident insurance in your CTC. So, unless you lot run into the bacon pause-up and do the math, you cannot exist sure nigh what you'll get in paw.

You need to make sure that you lot are not losing out because of lazy salary structuring past some Hour personnel. Then customise your CTC according to your needs.

Restructure the basic pay

The bones, probably the clamper of your bacon, includes basic pay, HRA and oft dearness (DA) and special allowance. Apart from HRA, every component is fully taxable. An easy mode to reduce tax liability is to cut bones pay and adjust it as perks or long-term benefits. If you take a special allowance component, arrange it every bit a tax-gratis component.

However, you demand to weigh the pros and cons before tinkering with your bones. Your HRA (usually, twoscore-50% of the bones) and EPF (12% of the basic) are directly linked to the basic. Also, if yous want to utilize for, say, a motorcar or home loan in the short term, you may not want the bones pay to be too depression.

A higher basic would mean a higher HRA, DA and provident fund contributions. The DA volition be taxable and the PF contributions are tax-free, simply information technology will reduce your have-home salary. On the other paw, reducing the basic pay volition hateful a lower contribution towards retiral benefits, which may non exist good in the long run. Also, if you alive in a rented business firm, recalculate your taxation benefits on HRA earlier lowering the basic.

The thought, is to accept an HRA as close to the actual rent you lot pay, which should ideally be a figure close to the HRA you receive plus 10% of yous basic (run into HRA calculations). Choose one of the following two ways to restructure the bacon with maximum taxation benefits.

Increase in-mitt bacon

Benefits such as get out travel allowance (LTA), medical and conveyance allowances serve two purposes. One, they increase the net takehome salary. Two, they make the bacon construction more tax-efficient. Even so, the limitation is that there are caps on most of these perks. For instance, you lot can claim upwardly to a maximum of Rs 15,000 every year for medical reimbursements, Rs 26,400 for food coupons, Rs five,000 as almanac gifts and Rs 19,200 as travel allowance on a yearly basis.

Also, keep in mind that you volition have to produce original bills and receipts to claim some of these expenses. And then, make sure they are inside the claimable limit. Take advantage of perquisites if yous are planning to buy a car or join a professional person class while working. Rather than taking a loan, if your employer funds the expense and includes it as a part of your CTC, your tax outgo can reduce significantly.

This is because y'all are taxed merely on the perk value. For instance, if you lot plan to purchase a Rs 6 lakh automobile on loan, you will have to pay roughly a monthly EMI of Rs xiii,000 for 5 years, which volition be a post-tax expense. The revenue enhancement outgo over five years on Rs 7.8 lakh will be slightly more than than Rs 2 lakh.

However, if the visitor shows it every bit a perk, y'all are taxed just for the perk value of the motorcar, which is between Rs i,800 a calendar month (for cars of up to 1600 cc) and Rs ii,400 a month (for cars bigger than 1600 cc). The only disadvantage is that, legally, y'all don't own the car. Only when y'all quit, you may request the visitor to let y'all to buy the vehicle at depreciated cost.

This dominion holds truthful for other big ticket expenses like laptop, gadgets, except in case of rented accomodation. When information technology comes to a 'company leased firm versus selfrented accommodation', HRA wins. This is because rather than getting a tax-exemption for HRA, a prerequisite value (rent paid or 15% of the bones, whichever is lower) will get added to your taxable income, which would hateful a higher taxation bill.

Optimise long-term savings

If you lot want to go along your basic intact but practise not listen a slightly lesser take- abode pay, reduce your assart and increment your retiral benefits to reduce your tax liability. The employer'southward contribution to PF is linked to your basic (12%) and unalterable. However, yous tin can increment yours using the voluntary provident fund (VPF) route. VPF is even better than PPF because while both earn similar returns, PPF has a lock-in menstruation of 15 years.

Your EPF contributions can be withdrawn without any taxation implication after five years of service. If tax liability is non zippo after exhausting the Department 80C investment limit of Rs 1.5 lakh, contribute towards NPS to claim an boosted Rs 50,000 deduction under the new Section 80CCD (1b). "An employee'south contribution is too considered as a self-contribution and therefore eligible for deduction under Department 80CCD (1b). One can first maximise his claims under Section 80C and and then merits any residual under the new section," says Archit Gupta, founder and CEO, ClearTax.in. NPS, still, does not enjoy as high a liquidity as PF. Withdrawal is only allowed at retirement or under special circumstances.

Not all long-term benefits are tax-efficient, and you may want to get rid of a few besides. For case, gratuity, another common long-term benefit is tax-free up to xv days of basic pay or Rs 10 lakh, whichever is lesser. Withal, it is payable only later on v years of service. Then, it is redundant if yous do non programme to stick around for so long. Although non a very big component, y'all should endeavor and adjust the money under some other head.

Tax and tweaks

A quick checklist of tax rules for major components and how to tweak them to go maximum benefits.

Investing the savings

If you lot have an education loan running, paying it dorsum should be your priority. You go a tax benefit under Section 80E for paying the interest back. Also, financial planners suggest prepaying a loan subsequently the moratorium flow rather than investing as there will be no prepayment charges. "If this your commencement job and your bones is higher than Rs 15,000, you may even consider opting out of the EPF and instead pay back the loan," says Vaibhav Sankla, Director, H&R Cake India.

"It is amend better to pay back a loan where you are paying 12-13% involvement than invest in an instrument that fetches you lot viii.7% returns," he adds. Prepaying in the before years is a taxation-efficient strategy as well, when the involvement component is higher. This is considering there is no cap on how much you can claim under Section 80E. However, you have a fourth dimension limit of eight years to merits this do good.

Another benefit that people living with family miss on is HRA. Fifty-fifty if you are living with parents, y'all can merits a deduction for house rent, provided your parents own the firm. They volition exist taxed on this, merely can claim a apartment 30% of the annual rent as deduction for maintenance expenses such as repairs, insurance, etc., irrespective of the bodily incurred expenditure. So, if y'all pay Rs 12,000 a calendar month, your parents volition accept to pay tax on just Rs 1 lakh. Even if this earning is above the the basic Rs 2.5 lakh exempt limit (Rs iii lakh if they are in a higher place 60 and up to Rs 5 lakh if above fourscore years of historic period), y'all can make it tax-costless.

"The amount above the bones exemption limit can exist invested in their name under tax-free Department 80C options" says Sudhir Kaushik, Co-Founder & CFO, Taxspanner.com.

Then:

one. If HRA = Hire paid (Rs 12,000), the maximum deduction you lot tin merits is Rs 9,600 (rent paid less 10% of bones). So, y'all pay tax on Rs 2,400.

2. If HRA > Rent paid (Rs x,000), the maximum deduction yous can merits is Rs 7,600 (rent paid less x% of basic). Here, the taxation liability is even higher. You lot pay tax on Rs 4,400.

three. If HRA< Hire paid (Rs 15,000), the maximum deduction yous tin can merits is Rs 12,000 (actual HRA). Here you are paying a college rent (Rs 3,000) than actual HRA and therefore losing on tax benefits.

four. If HRA < Hire paid (HRA+x% of basic is equal to Rs 14,400), the maximum deduction you can claim is Rs 12,000 (actual HRA). This is ideal.

**How young earners can grow their salary with their career**

vii. Salvage FOR AN EMERGENCY

Caught in the thrill of making money, the urgency to buy things and eagerness to save for bigger goals similar a firm and a car, the new earners typically forget the preparation for financial emergencies. Be information technology the sudden loss of task, medical eventuality or sudden financial support required past a family member, you lot will need to be gear up for contingencies.

So the first thing to do, fifty-fifty before you lot kickoff saving for smaller, curt-term goals, is to build an emergency corpus. This should be equal to iii-6 months of your household expenses, and should likewise include any loan repayments and insurance premium obligations. This amount should be invested in such an artery that it is easily accessible and is not subject area to market fluctuations.

"The all-time option is to put information technology in a brusk-term debt fund, liquid fund or a sweep-in depository financial institution account. This will ensure easy availability and higher rate of interest for your money," says Maalde.

Some people also adopt to utilise credit cards to tide over financial emergencies, but call back that these are useful but if you restrict the credit to i month. Otherwise, the cost of loan will be prohibitively high and defeat the purpose. And then, before you lot continue a spending spree with your pay bank check, save the amount for a rainy mean solar day.

Saugata Palit, 24 years, Delhi

Designation: Senior executive

Started piece of work at 23 years

Flying start

1. Budgets using Excel sheet. Has short-term goals.

two. Has adequate health insurance.

3. Has high credit score.

Take-off troubles

1. Fully invested in debt.

two. Has included parents in a family floater program.

3. Low exposure on investment tools.

As well Read: How young earners tin can grow their salary with their career

8. Avert DEBT TRAPS

You are probably the most vulnerable when it comes to debt traps as you start working. With few responsibilities and the new-found ability of money and credit card, information technology'south hard to curb the consumerist urges. As Pai says, "You should empathise the difference between needs, wants and greed." Credit card is not the simply path to debt hell. Here are the various means you tin plunge into liabilities when you start working:

If you roll over credit card dues

"When I started earning, I had a card with a limit of Rs xl,000, but I got and then carried abroad that one time I spent Rs 45,000 in a month. That was a wake-up call. I repaid the amount and stopped using the credit carte du jour," says Palit. He hasn't carried out a single credit card transaction in the past six months.

Nayyar, on the other hand, has avoided this situation with bailiwick and smart usage. "I use a mix of credit and debit cards. The credit card is used but to earn and redeem points," says Nayyar. He besides makes certain to pay the entire neb every month and has never rolled over the due corporeality.

This is a key dominion for credit card usage. Do not coil over the due amount and repay in full because the cards charge a very high involvement of virtually 3% a month. So if you get a bill of Rs 10,000 and pay only the minimum due amount of 5%, you will take to pay an actress Rs 21,978 afterward a year. "Fix a spending limit for yourself, say, 20% of your income. Merely if yous tin't subject area yourself, utilize a debit card," advises Jhaveri.

"At that place are so many lucrative offers on cards that people don't recollect twice almost taking these upwards. Avoid buying expensive gadgets on loan fifty-fifty if these comes with 0% interest offers. These will add together up and impact your other investments," says Iyer.

If yous accept as well many loans

The like shooting fish in a barrel option of buying on credit can be your downfall if you practice not set limits. Taking a personal loan while running loans for a car and a home can strain your finances, making it difficult to invest or save. As a rule, do not spend more than than 40-45% of your income on loan repayments. Of this, 25-35% should be for home loan repayment and the residue for other forms of debt, including car and credit carte du jour loan.

If yous take personal loan for spending

Given the ease of securing a personal loan with pre-canonical amounts, it is easy to give in to the urge. Know that personal loan is one of the most expensive forms of loan after credit cards and charges 20-24% interest per annum. Avert these at all price.

If you buy a house with high EMI

Buying a house is a dream for nigh new earners, simply consider several factors earlier taking the large decision. "Know the difference between stock-still and floating rate loans and sympathize how EMIs are calculated," says Pai.

Understand that the EMIs for a home loan are large and a long-term delivery. And so you need to exist sure of your earning capacity on a sustained basis, otherwise it volition turn into a liability that will bear upon all your other goals.

If you sign on equally a guarantor for a loan

When you are single and employed and have friends you lot tin can't decline, you can exist an piece of cake target for a debt trap. If yous sign on as a guarantor for a friend's loan, understand that if he cannot repay the loan, y'all volition be asked to exercise so. The guarantee amount will prove every bit outstanding liability in your credit card and affect your loan eligibility. And so remember twice before agreeing to such an arrangement.

If you don't budget

If you fail to go on track of your expenses on a monthly basis, at that place is a proficient take a chance that you will run out of funds before the calendar month ends. You may then accept to consider loans to fulfil your needs.

(With inputs from Chandralekha Mukerji)

etheredgeineder99.blogspot.com

Source: https://economictimes.indiatimes.com/wealth/plan/eight-money-tips-to-help-young-earners-plan-their-finances/articleshow/52807644.cms

Belum ada Komentar untuk "Mom Talks About Debt Draws a Budget Plan"

Posting Komentar